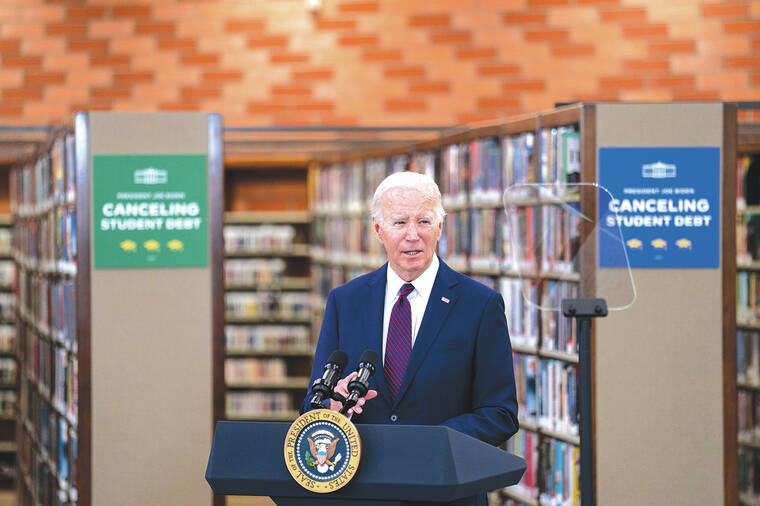

Biden cancels billions in student loan debt, a centerpiece of his campaign

WASHINGTON — President Joe Biden announced another round of student loan forgiveness Wednesday, canceling $7.7 billion in debt for 160,000 people in what has become a centerpiece of his campaign for reelection.

The announcement builds on Biden’s strategy of chipping away at college debt by refining existing programs, even as his administration pursues an even larger plan over the opposition of Republicans.

Many borrowers in this round of forgiveness, who qualified through public service loan forgiveness, the president’s SAVE plan or another income-driven repayment plan, have already begun receiving emails notifying them of their approvals, the Education Department said in a statement.

The Biden administration has now canceled about $167 billion in loans for 4.75 million borrowers, or roughly 1 in 10 federal loan holders. The president has set forward a much bigger goal: forgiving debt for nearly 30 million borrowers as soon as this fall. But the broader program is still being finalized and could fall victim to legal challenges, as Biden’s first, far more ambitious attempt at mass debt cancellation did.

Forgiving student loan debt is a key part of Biden’s outreach to the younger voters who overwhelmingly supported him in 2020 but have shown signs of drifting away.

“From Day 1 of my administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity,” the president said in a statement.

To keep the loan forgiveness rolling despite court challenges, the Biden administration has in many cases overhauled or made better use of programs that were already on the books.

In some cases, borrowers discovered that their monthly payments had been miscalculated, often for higher amounts than they actually owed.

Of the total announced Wednesday, $5.2 billion in forgiveness went to about 66,900 borrowers who qualified through adjustments that the Education Department made to the Public Service Loan Forgiveness program, which aids teachers, firefighters and other government and nonprofit workers.

Congress created the public service program in 2007, but it was plagued by poor coordination between the department and loan servicers which meant that an overwhelming share of applicants were denied for more than a decade. When Biden came into office, only 7,000 people who applied for relief through the program had been approved, administration officials have said.

About $600 million in relief will go to around 54,300 borrowers who are enrolled in the SAVE plan, which ties monthly payments to income and household size, and who took out smaller loans for graduate school. All borrowers enrolled in the plan can receive forgiveness after 25 years at the most, but borrowers who took out $12,000 in loans or less can qualify after 10 years of payments.

An additional 39,200 borrowers enrolled in other income-driven repayment plans also had $1.9 billion forgiven through “administrative adjustments” to the number of payments they owed. The department said those adjustments were largely to correct a misuse of forbearance by certain loan servicers.

The department has also leaned on other methods to extend debt cancellation, including discharging loans held by students who the department found were defrauded by their schools. Just this month, for example, the department forgave the federal loans of the 317,000 people who attended the Art Institutes.

The much larger part of the strategy — which involves forgiving runaway interest on loans that grew far beyond the original amount borrowed — is still pending, as the administration works to approve new rules. The administration has said more than 25 million people could qualify for relief under those regulations.